are withdrawals from a 457 plan taxable

For this calculation we assume that all contributions to the retirement account were made on a pre-tax or tax-deductible basis. If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal.

The amount you wish to withdraw from your qualified retirement plan.

. New York Treatment of Distributions relating to Section 457 Deferred Compensation Plans. Among the benefits for retirees is Alabamas tax-friendly system. An additional election to defer commencement of distributions from a section 457b plan and the cost of living adjustments to the 7500 limitation on maximum deferrals under a section 457b plan.

Theres some good news for those participating in a 457 plan. Taxation of retirement account withdrawals is fully applied. 457b In-service non-hardship employee withdrawals.

There is no tax on Social Security income. The amount you wish to withdraw from your qualified retirement plan. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

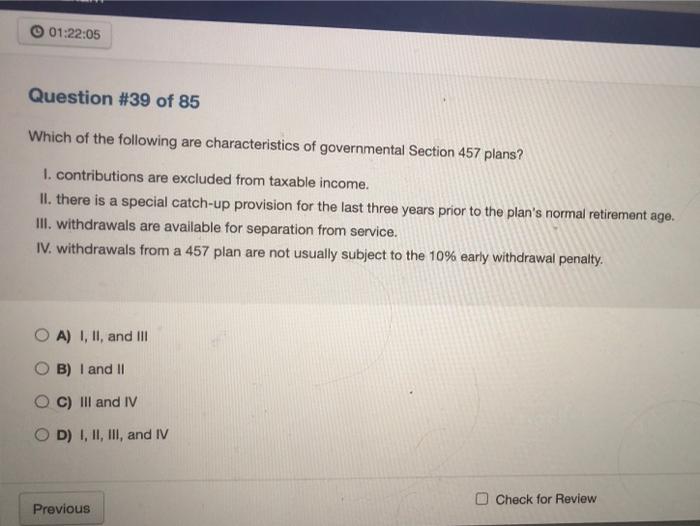

Unlike other retirement plans under the IRC 457 participants can withdraw funds before the age of 59½. Your marginal state tax rate or the difference between it and the regular rate depends on your income. Withdrawals are subject to income tax.

IRC 457 Early Withdrawal. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 planUnlike other tax-deferred retirement plans such as IRAs or 401ks you wont face a 10 percent early distribution penalty even if youre under age 59 ½ For example if you take a 15000 distribution youll owe income tax on the distribution but you. Service distributions from a section 457b plan if the total amount payable to the participant does not exceed 5000.

Are distributions from a state deferred section 457 compensation plan taxable by New York State. Plan 403b is very similar to Plan 457b. Withdrawals are subject to income tax.

In fact public sector employees may have the option to choose one or the other or sometimes even both. Some companies will allow active employees participating in a qualified employer retirement plan to withdraw a portion of their plans account balance upon request without demonstrating a specific financial need - its called an in-service withdrawal or an in-service. However distributions received after the pensioner turned 59 12 would qualify for the private pension and annuity income exclusion of up to 20000.

Withdrawals from 457 plans are taxable but early withdrawals are not punished. For this calculation we assume that all contributions to the retirement account were made on a pre-tax or tax-deductible basis. If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal.

Should You Use Your 457 B White Coat Investor

Can I Do Monthly Rollovers From My 457 To An Ira

In Service Distributions From Gov T 457 B Plans Retirement Learning Center

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

State Of Louisiana Deferred Compensation Plan Irc Section 457 Plan New Egtrra Pension Legislation Flexibility Increased Savings Annual Dollar Deferral Ppt Download

Is Alabama A Mandatory Or Elective Taxes 457 B Plan Ozark

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

How A 457 Plan Works After Retirement

Everything You Need To Know About A 457 Real World Made Easy

How 403 B And 457 Plans Work Together David Waldrop Cfp

Solved 01 22 05 Question 39 Of 85 Which Of The Following Chegg Com